Financial Advice is a conversation like no other.

Looking for a Trusted, Independent Financial Advisor in Raleigh, NC?

Olde Raleigh Financial Group is an employee-owned, fee-based financial advisory firm dedicated to personalizing your investment journey. We offer comprehensive wealth management services, including:

✓

Retirement Planning

✓

Tax Planning

✓

Investment Management

✓

401k Allocation

✓

Social Security Analysis

✓

Education &

College Planning

✓

Insurance Planning

✓

Estate Planning

Independent & Client-Focused: We prioritize your best interests, free from conflicts of interest.

Experienced Team: Benefit from the combined wisdom and perspective of our seasoned advisors.

Fee-based Structure: Pay only for the services you receive, ensuring transparency and alignment.

Personalized Approach: We take the time to understand your unique financial goals and aspirations.

Technology-Driven: Leverage cutting-edge tools for clear communication and efficient plan management.

Our Commitment to You

Ready to start a conversation?

Call us today at (919) 861-8212 or schedule an appointment to learn more.

What can we help you with?

-

Life Insurance

Planning for the unexpected is a wise way to help protect you and your family. That’s why insurance plays a crucial part in your financial plan. We’ll help you explore the various insurance options for your family’s unique needs.

-

Long-Term Care

The most pressing financial concerns of many people tend to revolve around providing for their families, assuring adequate retirement income and preserving their estates for the future. However, few people consider what would happen to their families, themselves and the assets they have worked so hard to accumulate over the years if they were to require long-term care due to a prolonged illness or disability. We can help you understand your choices and will help you navigate the underwriting process so you can find the insurance that is right for you.

-

Charitable Giving

We can help you create a charitable giving plan that not only helps the organizations you’re passionate about, but also has the potential to generate tax benefits and further your overall wealth management plan.

-

Retirement Planning

To achieve the retirement you’ve envisioned, you’ll need a strategic plan to get you there – and beyond. Retirement isn’t merely a destination, it’s a journey over many years. Our goal is to work with you to create a plan that will not only help you accumulate assets, but also preserve them and make them last.

-

Educational and College Planning

If your aim is to one day fund an education for a child or children you love – or even yourself – we can help. There are many programs and plans available to help you reach your goal. With our guidance, we can help you select and use the one that’s just right for your particular needs.

-

Streamline Investment Portfolio and Security Planning

Every investor is different – unique goals and individual tolerance for risk require different investment instruments be used and allocated. We’ll help you explore the many options you have concerning stocks, bonds, mutual funds and more, to determine which will fit best into your portfolio.

-

Asset Allocation including 401(k) Asset Allocation

Don’t know what funds to choose in your company’s 401(k) or when to re-balance them? If your company offers a Roth 401(k) should you choose it? How do you manage company stock grants? We help clients navigate these common retirement plans concerns.

-

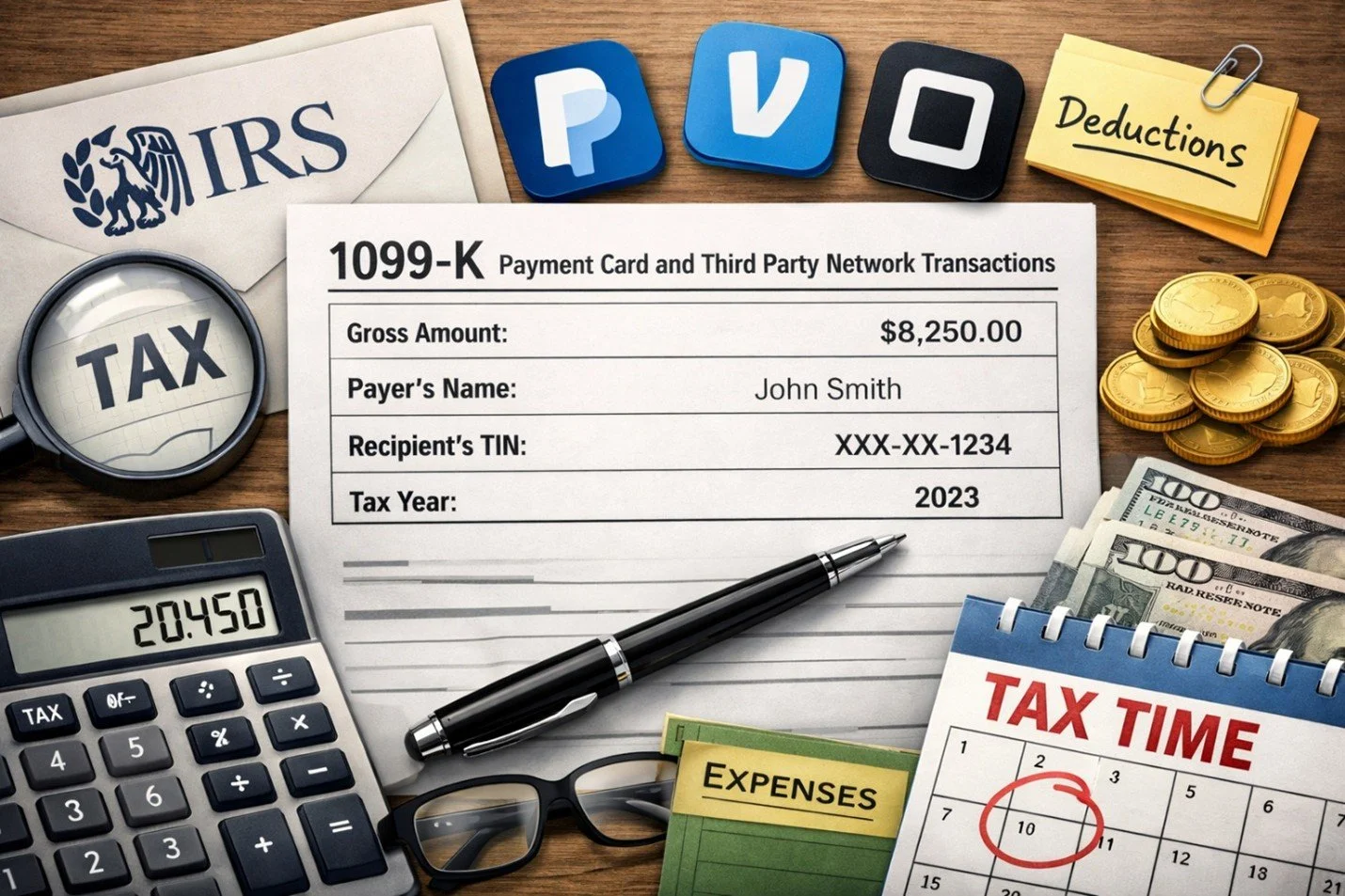

Tax Planning

Should you do Roth Conversions? To help offset taxes, should you do some charitable giving and if so how much? What do your future IRA Mandatory Distributions project to be and what are the projected tax implications? We can help you and your CPA with these challenges.

-

Tax Return Review

We review tax returns for potential financial planning opportunities.

-

Professional Services Introductions

Do you need a Will redone or perhaps a new CPA relationship. We cultivate relationships with local professional service providers and are happy to provide introductions.

PODCAST

Soundtrack to a Financial

Advisor's Life

BLOG

Keeping you informed and equipped for the financial road ahead