Raleigh NC Financial Advisor: Avoid Emotionally Charged Financial Decisions

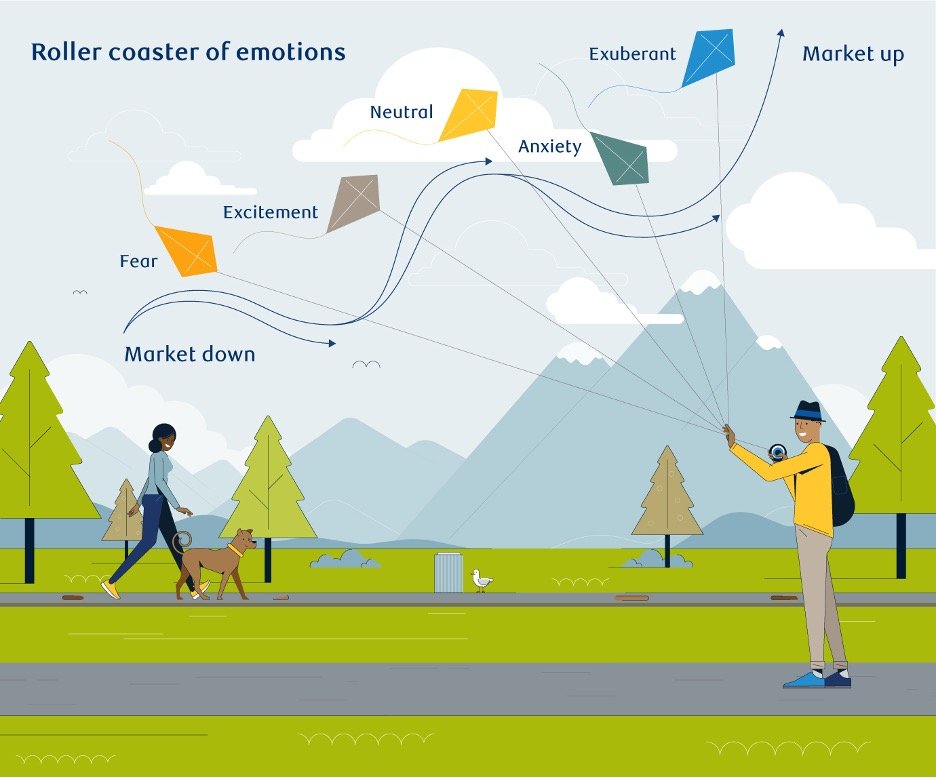

Your emotions can influence the choices you make. Learn how to better equip yourself to make emotionally well-grounded financial decisions.

When we are in a heightened emotional state, our decisions are often made to satisfy immediate needs, neglecting the potential future consequences. This is also true when it comes to financial decisions. It can be hard to accept a dip in the value of your investments, but it can be even harder to recover from bad choices that were made without looking ahead.

It's important to remember that remaining calm during all market environments and staying focused on the long term is critical to reaching your financial goals.

Below are a few suggestions on how to better manage your emotions, and in turn, your strategy planning and decision-making:

1. Ask big-picture questions

During times of market volatility, it may be helpful to revisit your goals to see if anything has changed. Consider asking yourself questions such as:

Are my goals still the same now that my investments have declined?

Are there near-term financial needs that can wait, or do I have other sources of liquidity to help hold me over so I can stay invested longer?

Is my portfolio aligned with my risk tolerance and my time horizon for when I might need the money?

Does my portfolio have an appropriate level of diversification?

If the answer is “yes" to these questions, then ask yourself why you need to make any changes given the risks involved in getting it wrong. If the only thing that has changed is the current value of your portfolio, should this affect your long-term plan?

These bigger-picture questions can help shift the focus away from short-term discomfort. However, if the answer to any of the questions is “no," then discuss these changes with your advisor; they will review your plan and work with you to adjust as needed.

2. Avoid constantly checking your investment

Do you frequently monitor your investments? Reducing the psychological effects of market ups and downs is achievable by looking at it less often and concentrating on your overall wealth plan. It is usually more unpredictable over short time frames, so the more often you look, the greater the chance you'll observe major changes in your portfolio's worth. Monitoring your investments less often may indicate that you're more likely to observe long-term patterns.

3. Speak with a financial advisor or financial planner

Many advisors have been through multiple market cycles and have seen difficult periods before. Having an advisor who can share their expertise and experience and provide you with advice during difficult times can be extremely helpful in keeping your plan on track.

Thinking about switching to cash?

If you are thinking about moving to cash, one thing to keep in mind is that when inflation is high, sitting on excess cash will normally result in negative real returns. Here are some questions to consider:

What is my plan for getting back into the markets?

What are the tax implications of my decision?

Where should I direct my savings in the meantime?

How long can I afford to be out of the market while ensuring my goals are still achievable?

How will I know when (and if) it's safe to get back into the stock market?

If I re-enter the market, how can I be more comfortable with volatility in the future?

History tells us that it is generally a bad decision to sell in down markets with the hope of timing your way back into the market with good results. With that said, market volatility can provide opportunities to find some bargains and even offset some gains with losses.

Dos and don'ts for controlling emotions

Do seek advice from a financial advisor or financial planner.

Do understand your investing timeline, risk tolerance, goals and objectives.

Do find the correct information about your investments (e.g. analyst reports, financial statements, etc.).

Do stay focused on your personal, customized wealth plan.

Don't panic and act before understanding the implications of your decisions.

Don't check your investments too frequently.

Keep your emotions in check

Financial plans shouldn't be derailed by uncertainty and periods of volatility. Reacting emotionally often complicates the process, and the more you try to time your decisions according to the markets, the worse off you may be.

Even though financial planning is driven by facts and numbers, it's also important to take into account your feelings and beliefs about money. Nearly everything we do requires it in some shape or form—and yet money is intensely personal. People dedicate so much of their lives to earning it, and humans are emotional beings by nature.

As you grow your wealth, it's important to work with a financial advisor who can share their experience and insight to help you make well-grounded financial decisions.

Sources:

https://www.cnb.com/personal-banking/insights/emotions-and-financial-decisions.html

https://www.investopedia.com/articles/basics/10/how-to-avoid-emotional-investing.asp

Disclosures:

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.