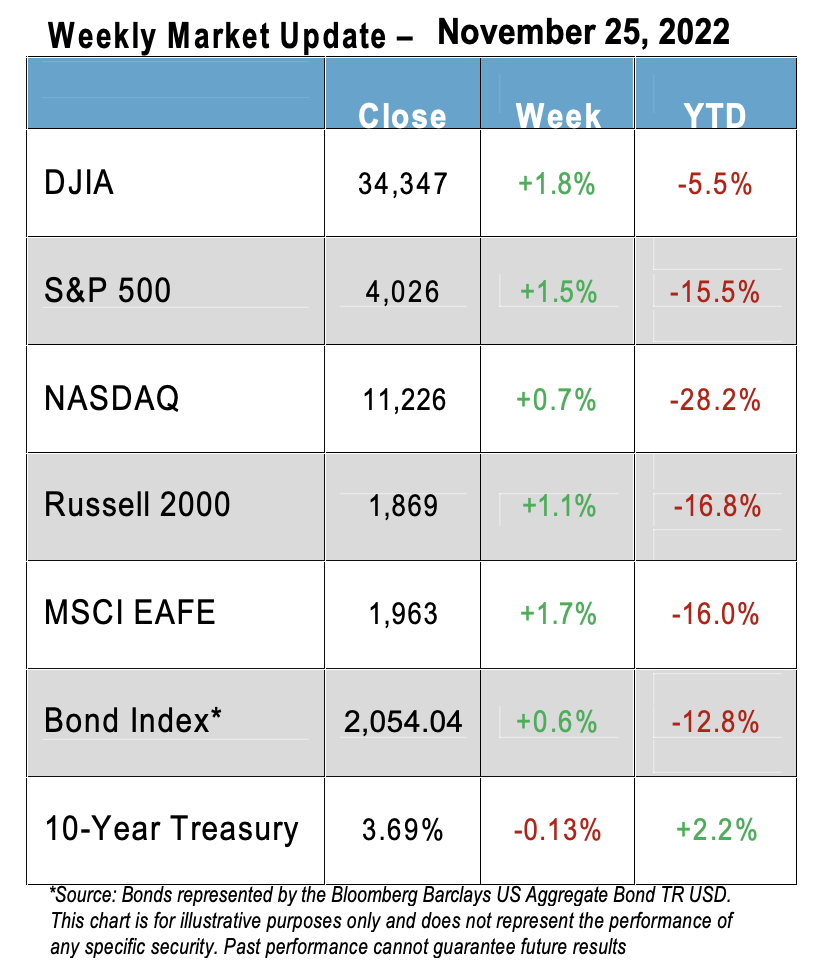

Wall Street Thankful for Positive Week As Retail & Tech Earnings Are Decent & New Home Sales Surprise On The Upside

With a short-holiday trading week due to Thanksgiving, markets were quiet in terms of

volume but still turned in a positive week for investors

There was not much economic data for Wall Street to react to, and most of the positive news was from earnings reports, where there were a number of big names that turned in earnings that were better than predicted

Specifically, big retailers Best Buy and Abercrombie & Fitch reported strong results, as did bell-weather tech names like Dell Technologies and industrials-giant Deere

Disney was in the news as former CEO Bob Iger returned as CEO for the next two years

The Treasury market was subdued too, as the 10- year Treasury fell 13 basis points to 3.69% and the 2-year fell 2 basis points to 4.48%

Of the economic data received this week, it was a mixed bag, as the Durable Goods Orders and New Home Sales were better than expected, but Weekly Initial Claims and Manufacturing and Services PMIs were worse than expected

Every one of the 11 S&P 500 sectors were up this week, with Materials (+3.0%) and Utilities (+2.9%) making the biggest jump and energy (+0.2%) bringing up the rear

Energy dropped more than 4% as WTI Crude settled around $76/barrel

With the November employment figures due to be released next Friday, all eyes will be on the labor market this week.

Stocks Decline Slightly as Investors Ramp Up Their Worries

Well, it wasn’t the crazy week we saw last week, as most of the major U.S. indices retreated slightly and closed slightly lower. On the whole, the value names outpaced the growth names, the mega caps outpaced the small caps and the tech names underperformed relative to the larger market stalwarts.

There was a decent amount of economic data received this week, and Wall Street fixated on it in an effort to gauge the Fed’s next move and whether a recession might be on the horizon. Half-way through the week, the Commerce Department reported that retail sales excluding the volatile auto segment rose 1.3% in October, significantly above consensus expectations and the biggest gain since May.

But that report was tempered by confounding earnings reports and news from a few big retailers, specifically Target, which warned about softening discretionary spending. That was made worse by other retailers (the Gap and Old Navy) suggesting that sales of baby clothes were dropping, causing many to suggest that consumers were really struggling – as it’s one thing when men’s clothing drops but it’s another when parents cut back on spending for their babies. But then Wal-Mart and Foot Locker reported better than expected earnings, painting a better picture.

While data suggested that the labor market remains strong, a number of big companies started announcing layoffs, including Amazon and Twitter. Jobless claims’ data saw 222,000 workers filing for unemployment benefits and that number has remained relatively consistent since Labor Day.

Industrial production fell unexpectedly in October and a gauge of manufacturing activity in the Mid-Atlantic region dropped to its lowest level since early 2020. But much of Wall Street’s focus was when Producer Price Index numbers were released, giving hope to the peak-inflation narrative as core (less food and energy) producer prices in October were relatively flat – the first time that has happened in two years.

Producer Price Index Follows Consumer Price Index Trend

On Tuesday, the U.S. Bureau of Labor Statistics reported that the Producer Price Index for final demand increased 0.2% in October, below consensus expectations for a 0.4% increase.

In addition:

Final demand prices rose 0.2% in September and were unchanged in August.

On an unadjusted basis, the index for final demand advanced 8.0% for the 12 months ended in October.

In October, the rise in the index for final demand can be attributed to a 0.6% advance in prices for final demand goods. In contrast, the index for final demand services decreased 0.1%.

Prices for final demand less foods, energy, and trade services advanced 0.2% in October following a 0.3% rise in September. For the 12 months ended in October, the index for final demand less foods, energy, and trade services increased 5.4%.

Final Demand Goods

The index for final demand goods moved up 0.6% in October, the largest advance since a 2.2% rise in June. Most of the October increase can be traced to a 2.7% jump in prices for final demand energy. The index for final demand foods advanced 0.5%. Conversely, prices for final demand goods less foods and energy decreased 0.1%.

Product detail: In October, 60% of the increase in prices for final demand goods is attributable to the index for gasoline, which rose 5.7%. Prices for diesel fuel, fresh and dry vegetables, residential electric power, chicken eggs, and oil field and gas field machinery also advanced. In contrast, the index for passenger cars declined 1.5%.Prices for gas fuels and for processed young chickens also fell.

Final Demand Services

The index for final demand services fell 0.1% in October, the first decline since moving down 0.2% in November 2020. Leading the October decrease, margins for final demand trade services fell 0.5%. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand transportation and warehousing services moved down 0.2%. Conversely, the index for fina l demand services less trade, transportation, and warehousing increased 0.2%.

Product detail: A major factor in the October decrease in prices for final demand services was the index for fuels and lubricants retailing, which fell 7.7%. The indexes for portfolio management, long -distance motor carrying, automobile retailing (partial), and professi onal and commercial equipment wholesaling also moved lower. In contrast, prices for hospital inpatient care increased 0.8%. The indexes for services related to securities brokerage and dealing (partial), apparel wholesaling, and airline passenger services also rose.

Retail Sales Up

Mid-week, the U.S. Census Bureau announced the following advance estimates of U.S. retail and food services sales for October 2022:

Advance estimates of U.S. retail and food services sales for October 2022 were $694.5 billion, up 1.3% from the previous month, and 8.3% above October 2021.

Total sales for the August 2022 through October 2022 period were up 8.9% from the same period a year ago.

The August 2022 to September 2022 percent change was unrevised from virtually unchanged.

Further:

Retail trade sales were up 1.2% from September 2022, and up 7.5% above last year.

Gasoline stations were up 17.8% from October 2021

Food services and drinking places were up 14.1%

Sources: bls.gov; census.gov; msci.com; fidelity.com; Nasdaq.com; wsj.com; morningstar.com: census.gov

Disclosure:

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.