Raleigh NC Financial Advisor: Power of Attorney

Do you have a financial power of attorney (POA)? Have you ever considered what would happen to your finances if you were unable to manage them on your own? Have you considered the potential risks and challenges of not having a power of attorney?

A power of attorney is a legal document that gives someone else the authority to act on your behalf in financial matters if you are unable to do so. This person, known as the agent or attorney-in-fact, can manage your financial affairs, make decisions about investments, pay bills, and take other financial actions per the power of attorney.

Importance of POA

By having a power of attorney in place, it can provide peace of mind and protection for you and your loved ones. It can be effective immediately or can become effective in the event of a specific trigger, such as your incapacity. It can also be temporary or permanent.

Here are a few reasons why a financial power of attorney is important:

Ability to Manage Finances: If you become incapacitated due to illness, injury, or other reasons, you may be unable to manage your own financial affairs. The power of attorney allows someone you trust to manage your finances and make important decisions on your behalf.

Avoiding Court Intervention: Without a power of attorney in place, your loved ones may need to go to court to obtain the authority to manage your finances. This can be time-consuming and expensive, and it can also result in someone you do not know, or trust being appointed to manage your affairs.

Preventing Financial Abuse: A financial power of attorney can help prevent financial abuse by giving someone you trust the authority to manage your finances and protect your assets. This can be especially important for seniors and others who may be vulnerable to financial scams and exploitation.

Maintaining Control: With a power of attorney, you can choose who you want to manage your finances and make important decisions on your behalf. This allows you to maintain control over your financial affairs even if you are unable to manage them yourself.

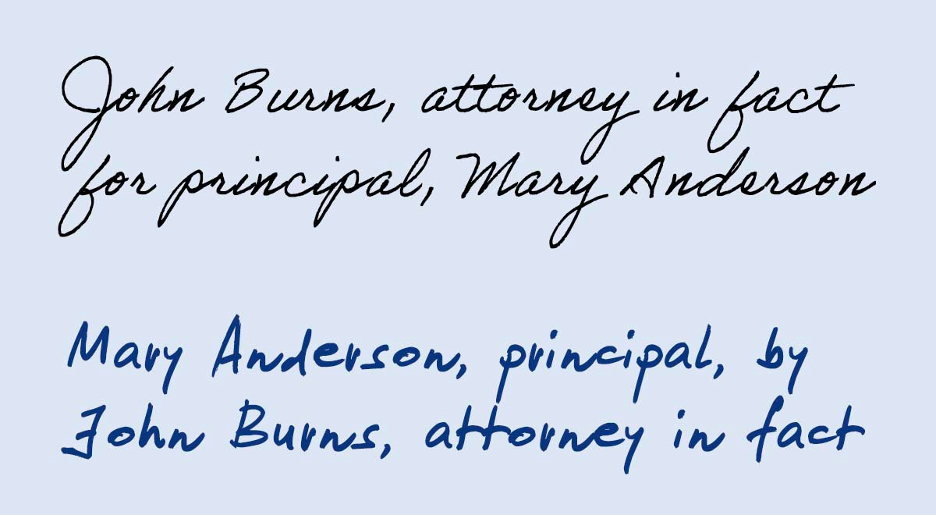

Agent or Attorney in Fact

When choosing an agent or attorney in fact, it is important to choose someone who you trust completely. This person should be responsible, reliable, and able to make sound financial decisions on your behalf. You may choose a family member, friend, or professional advisor.

A financial power of attorney can be a powerful tool. Therefore, you might want to consider including safeguards in the document to protect against abuse. For example, requiring two signatures on certain types of transactions.

When to Add POA on Financial Accounts

It's generally a good idea to put a financial power of attorney (POA) on your financial accounts as soon as possible, especially if you have concerns about your ability to manage your finances or if you want to ensure that someone you trust is able to manage your finances in the event of incapacity.

Here are some specific situations when you may want to put a financial POA on your financial accounts:

Aging: As you age, you may become more vulnerable to physical or cognitive decline that could impact your ability to manage your finances. A financial POA can ensure that someone you trust is authorized to manage your finances if you become incapacitated.

Illness or Injury: If you are diagnosed with a serious illness or injury, you may be unable to manage your finances on your own. A financial POA can give someone you trust the authority to manage your finances and make important decisions on your behalf.

Travel or Extended Absence: If you are planning to be away from home for an extended period of time, you may want to appoint a financial POA to ensure that your bills are paid and your finances are managed while you are away.

Business Ownership: If you own a business, a financial POA can be important to ensure that someone is able to manage your finances and make important decisions on behalf of your business if you become incapacitated.

What does a Financial Power of Attorney Cover?

The financial power of attorney should be tailored to meet your goals and specific needs. An agent can be given broad or narrow authority, depending on the specific needs that you may have. Some of the financial powers that can be included in a financial power of attorney may include:

Paying bills and managing bank accounts

Investing money

Buying or selling assets, such as real estate

Managing retirement accounts

Filing taxes and handling other financial matters

Your power of attorney should be customized to meet your needs. For example, the power of attorney may specify certain limitations on the agent's authority or require that the agent obtain approval from you before taking certain actions.

Bottom Line

Having a financial power of attorney in place can be an important part of estate planning, as it ensures that someone you trust is authorized to manage your finances if you become unable to do so yourself. It's important to choose someone who is responsible and trustworthy as your agent and to discuss your wishes and expectations with them in advance.

It's always a good idea to consult with an attorney or financial advisor when creating a financial power of attorney to ensure that it meets your specific needs and goals. This document must comply with the legal requirements of your state and should clearly state the types of financial decisions your agent is authorized to make.

Sources:

https://smartasset.com/insurance/how-much-does-long-term-care-insurance-cost

https://www.investopedia.com/how-much-is-long-term-care-insurance-7479941

https://www.forbes.com/health/senior-living/long-term-care-insurance/

Disclosures:

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.