Raleigh NC Financial Advisor: Business Continuity Planning

A business continuity plan (BCP) is a document that outlines procedures and strategies for maintaining essential business functions and operations during and after a disruptive event or emergency. The goal of a BCP is to minimize the impact of disruptions and ensure the organization can continue to operate as close to normal as possible.

A BCP typically includes a range of measures and protocols for responding to various types of disruptions, such as natural disasters, cyber-attacks, power outages, and other events that could disrupt normal business operations. It also includes a list of critical business functions and assets, and the resources required to support them.

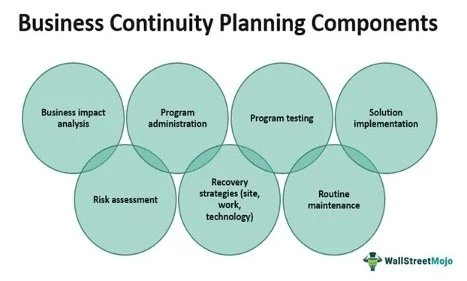

A well-designed BCP includes a comprehensive risk assessment, identification of critical business processes and infrastructure, and strategies for backup and recovery of critical data and systems.

It also includes a plan for communication with employees, customers, suppliers, and other stakeholders during the disruption, as well as guidelines for managing the crisis and resuming normal operations as quickly as possible.

Strategies for Business Continuity Plan

The strategies for business continuity plan can vary depending on the organization's needs and the potential disruptions it faces. Here are some common strategies that can be included in a BCP:

1. Risk Assessment: Identify the potential risks and hazards that could impact the organization and determine their likelihood and potential impact on the business.

2. Business Impact Analysis (BIA): Identify the critical business functions, processes, and assets required to support the organization's operations and prioritize them based on their importance to the business.

3. Disaster Recovery (DR): Develop a plan to recover and restore critical IT systems, data, and applications in the event of a disruption or outage.

4. Crisis Management: Establish a team and procedures to manage and respond to the crisis situation, including communication plans, emergency response procedures, and escalation protocols.

5. Alternative Site Planning: Establish alternative locations or work arrangements to ensure continuity of operations in the event of a disruption or evacuation.

6. Supply Chain Management: Identify critical suppliers and establish plans to ensure the continuity of supply chains in the event of disruptions or shortages.

7. Training and Testing: Regularly train employees and conduct drills to test the effectiveness of the BCP and ensure everyone knows their roles and responsibilities during a crisis.

By implementing these strategies, an organization can ensure that it is well-prepared to respond to potential disruptions and minimize the impact on its business operations.

What is the importance of a business continuity plan?

A continuity plan is essential for any organization, regardless of size or industry, because it helps to ensure the continuation of essential business functions during and after a disruptive event.

Here are some of the key reasons why a BCP is important:

Minimizes Downtime: A well-designed BCP can help minimize downtime and ensure that critical business operations continue during and after a disruptive event. This can help minimize the financial impact of the disruption and ensure the organization remains competitive.

Maintains Reputation: A BCP can help an organization maintain its reputation and build trust with stakeholders, including customers, suppliers, and investors. By demonstrating a commitment to preparedness and resilience, an organization can build confidence in its ability to weather disruptions.

Ensures Compliance: Many industries and regulatory bodies require organizations to have a BCP in place. Compliance with these requirements is necessary to avoid penalties, fines, and legal consequences.

Provides a Competitive Advantage: A BCP can give an organization a competitive advantage by demonstrating a commitment to preparedness and resilience. This can help attract customers, investors, and employees who value stability and continuity.

Protects Employees: A BCP can help protect employees by ensuring their safety during a disruptive event and providing clear guidance on what to do in an emergency.

Increases Efficiency: By identifying critical business functions and assets, a BCP can help an organization prioritize its resources and focus on what is most important. This can lead to increased efficiency and productivity.

Bottom Line

Business continuity plans are essential for any organization looking to safeguard itself from potential disruptions or disasters. When developing one, it’s important to consider all aspects of risk assessment, incident response planning, recovery strategies, and testing & training so you can create a comprehensive plan that covers all bases. A financial advisor or financial planner can help with your business continuity plan.

By taking the time to develop a thorough business continuity plan now, you can save yourself time—and potentially money—in the future when faced with unexpected events that threaten your operation.

Sources:

https://riskpublishing.com/what-does-a-business-continuity-plan-typically-include/

https://www.metrosales.com/blog/how-to-implement-continuity-planning-in-your-business-msi/

Disclosures:

This site may contain links to articles or other information that may be on a third-party website. Advisory Services Network, LLC is not responsible for and does not control, adopt, or endorse any content contained on any third-party website.

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.