January 2024 Stock Market Insights: Earnings Season Kickoff, Inflation, and Beyond

STOCKS ADVANCE AS EARNINGS SEASON KICKS OFF AND INFLATION SHOWS MIXED RESULTS

The first full week of trading in 2024 brought welcome news to most investors, as 3 of the 4 major equity indices were green for the week on the heels of a batch of 4Q2023 earnings from the big banks and mixed inflation data

When Friday’s final bell on Wall Street rang, the tech-laden NASDAQ had recorded an impressive 3.1% jump on the week and the large-cap S&P 500 saw a very good gain of 1.8%

The tech giants saw some very big weekly gains, driven by Meta Platforms (Facebook) and chipmaker NVIDIA

The mega-cap DJIA, on the other hand, only rose a modest 0.3% whereas the small-cap Russell 2000 declined 0.1%

With a lot of economic data this week, most eyes were on the Consumer Price Index and Producer Price Index reports, which came out toward the end of the week

Total CPI was up 0.3% month-over-month in December following a 0.1% increase in November. The shelter index jumped 0.5% and accounted for over half of the monthly increase in total CPI

Core CPI, which excludes food and energy, was also up 0.3% month-over-month

Total CPI is up 3.4% year-over-year, versus 3.1% in November, and core CPI is up 3.9% year-over-year, versus 4.0% in November

The Producer Price Index for final demand declined 0.1% month-over-month in December driven by a 0.4% drop in prices for final demand goods

The index for final demand, less food and energy ("core PPI"), was unchanged month-over-month

On a year-over-year basis, the index for final demand was up just 1.0% and the index for final demand less food and energy was up 1.8%

WTC Crude Oil was mostly flat this week, dropping about 15 cents/barrel

Volatility, as measured by the VIX, dropped almost 8% on the week

Markets will be closed on Monday in observance of the Martin Luther King, Jr. Day holiday

Weekly Market Update – January 12, 2024

*Source: Bonds represented by the Bloomberg Barclays US Aggregate Bond TR USD. This chart is for illustrative purposes only and does not represent the performance of any specific security. Past performance cannot guarantee future results

Stocks Advance as 4Q Earnings Season Starts

Most of the major equity indices advanced this week as the earnings season for 4Q2023 kicked off and Wall Street digested a slew of economic reports, principally inflation-related data. The smaller-cap Russell 2000 (-0.1%) declined for the second week in a row, but the mega-cap DJIA (+0.3%) managed to turn last week’s performance around. The large-cap S&P 500 (+1.8%) and the tech-heavy NASDAQ (+3.1%) both turned in very good weeks.

The big banks were among the first big group to report earnings this week and the results were mixed, with Bank of America dropping almost 2% after posting declining profits in the fourth quarter. And interestingly, Wells Fargo also dropped about 2% despite posting higher profits for the same quarter. Citigroup dropped about 1% after a $1.8 billion quarterly loss and that it was shedding 10% of its workforce.

Besides earnings, Wall Street paid attention to inflation reports and as with earnings from the banks, the results were mixed. On Thursday, it was reported that the Consumer Price Index came in modestly hotter than anticipated as prices were up 0.3% on the month and 3.4% from a year ago. Then on Friday the Producer Price Index came in lower than expected, registering a 0.1% decline in December. Both of these inflation gauges are encouraging that the Fed is likely done raising rates but each paints a different picture with respect to when the Fed might start cutting rates this year.

Mortgage Applications Up Almost 10%

Mortgage applications increased 9.9% from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending January 5, 2024.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) increased to 6.81 percent from 6.76 percent, with points remaining unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

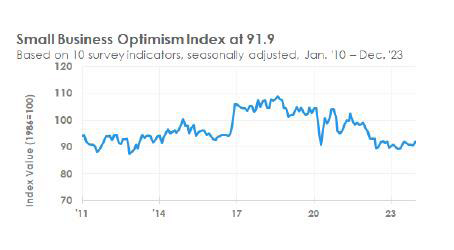

Small Businesses Still Worried Over Inflation

“The NFIB Small Business Optimism Index increased 1.3 points in December to 91.9, marking the 24th consecutive month below the 50-year average of 98.

Twenty-three percent of small business owners reported that inflation was their single most important problem in operating their business, up one point from last month, and replacing labor quality as the top concern.

Small business owners expecting better business conditions over the next six months improved six points from November to a net negative 36% (seasonally adjusted), and 25 percentage points better than last June’s reading of a net negative 61%.

Seasonally adjusted, a net 29% of owners plan to raise compensation in the next three months, down one point from November.

The net percent of owners raising average selling prices was unchanged from November at a net 25% (seasonally adjusted).

The net percent of owners who expect real sales to be higher improved four points from November to a net negative 4% (seasonally adjusted), the highest reading since January 2022.”

Additional Economic Data This Week

Initial jobless claims for the week ending January 6 decreased by 1,000 to 202,000.

Consumer credit increased by $23.7b in November, at a seasonally adjusted annual rate of 5.7% in November.

Revolving credit increased at an annual rate of 17.7%. Nonrevolving credit increased at an annual rate of 1.5%.

The November trade balancewas better than expected, showing a deficit of $63.2 billion.

The real goods trade deficit narrowed to $84.8 billion in November from $87.2 billion in October. That left the Q4 average 0.2% below the Q3 average.

Sources: nfib.com; bls.gov; federalreserve.gov; mba.org; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

Disclosures

Dow Jones Industrial Average (DJIA) is a price-weighted index of 30 actively traded blue chip stocks. Indexes are unmanaged and do not incur management fees, costs or expenses. It is not possible to invest directly in an index.

Nasdaq is a global electronic marketplace for buying and selling securities. Originally an acronym for "National Association of Securities Dealers Automated Quotations"—it was a subsidiary of the National Association of Securities Dealers (NASD), now known as the Financial Industry Regulatory Authority (FINRA). Indexes are unmanaged and do not incur management fees, costs, or expenses. It is not possible to invest directly in an index.

Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Indexes are unmanaged and do not incur management fees, costs, or expenses. It is not possible to invest directly in an index.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The U.S. Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending federal income taxes may be due on any earnings withdrawn. A 10% federal penalty tax and possibly state or local tax can also be added.

These are the views of the author, not the named Representative or Advisory Services Network, LLC, and should not be construed as investment advice. Neither the named Representative nor Advisory Services Network, LLC gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your Financial Advisor for further information.